How to Protect Your Plan From Inflation

Jay Abolofia, PhD, CFP® is a fee-only, fiduciary & independent financial planner in Waltham, MA serving clients in Greater Boston, New England & throughout the country. Lyon Financial Planning provides advice-only comprehensive financial planning for a flat fee to help clients in all financial situations.

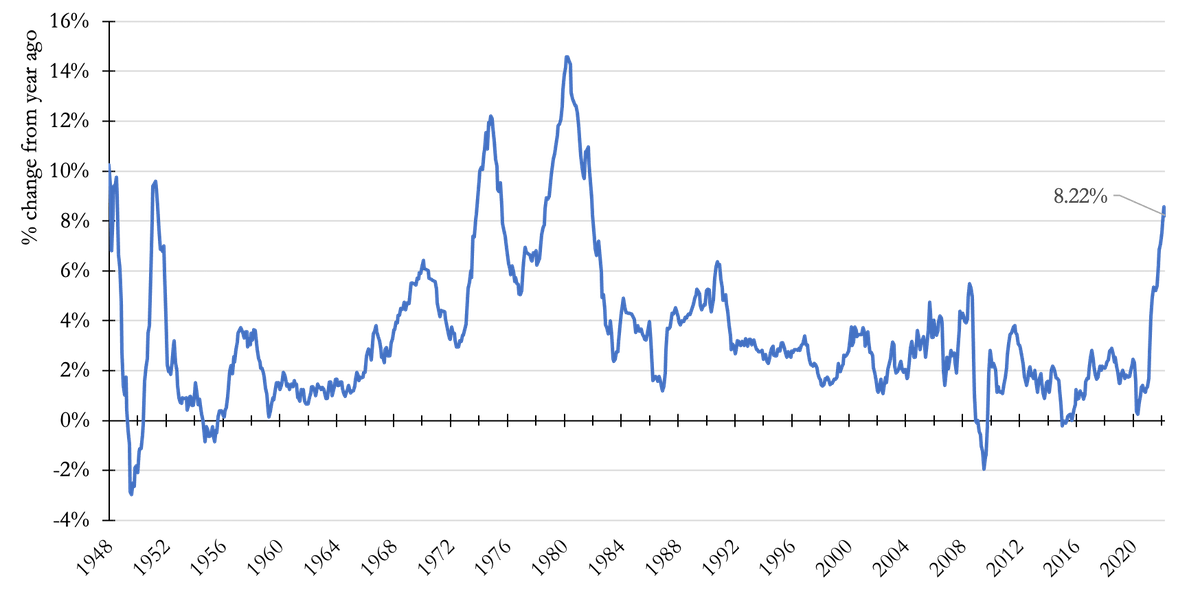

Consumer prices have been rising quickly over the last year with inflation currently running at over 8% on an annualized basis, the highest rate in over 40 years. Although markets expect inflation to come down significantly in the coming years, it’s an important reminder that the risks of high sustained inflation to your financial plan are ever-present—especially for those in or near retirement. In this article, I explore the following: 1) What is inflation, 2) How does inflation impact your financial plans for the future, and 3) How can you protect your financial plan from inflation.

What is Inflation?

Inflation measures the general increase in prices of goods and services over time. As prices rise, each dollar buys fewer goods and services, thus eroding the purchasing power of money. In other words, a dollar in the future buys less than a dollar today. For example, inflation of 8% per year can cut the purchasing power of money in half in just nine years! [1]

To best estimate inflation on the spending patterns of most US households, the Bureau of Labor Statistics produces the Consumer Price Index (CPI) tracking prices for a “market basket” of goods and services paid for by the average urban consumer. This basket is developed using detailed consumer expenditure data collected from thousands of households on what they actually bought throughout the year. Calculating a percentage change in the CPI represents a historical estimate of inflation experienced by most US households (Figure 1).

Figure 1. Historical inflation as measured by the Consumer Price Index for all urban consumers (1948-2022)

Source: US Bureau of Labor Statistics

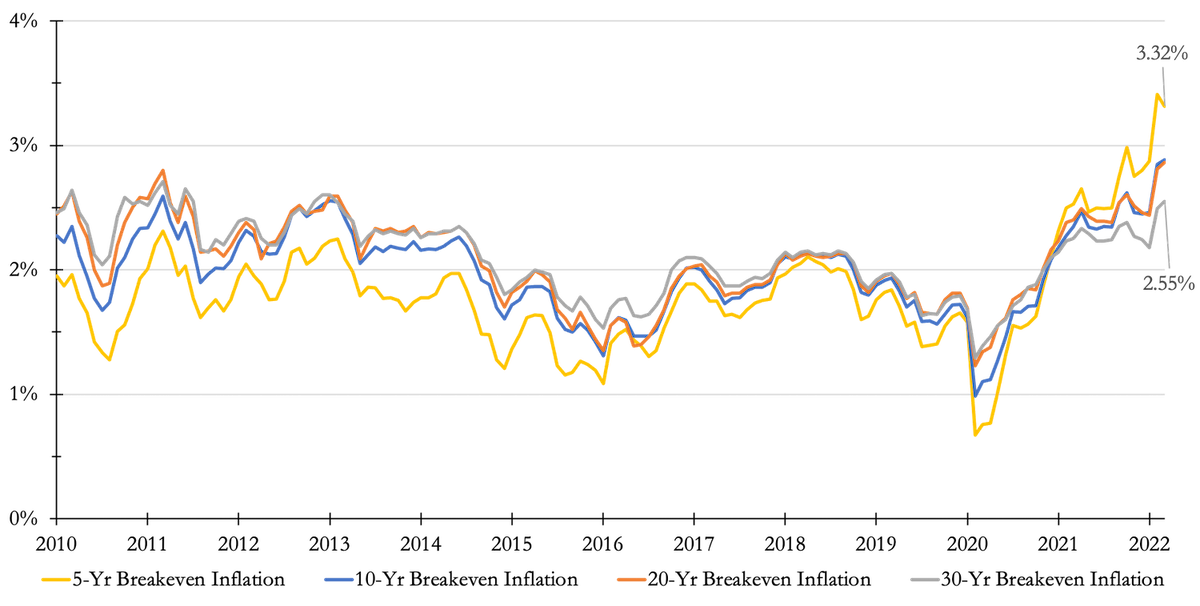

While the CPI can provide a retrospective measure of inflation, financial markets can provide a prospective measure. The difference in yields between US Treasury bonds that are and are not indexed to inflation reflect the market’s expectations of inflation—this is called the breakeven inflation rate. For example, Figure 2 shows that market participates currently expect inflation to average about 3.32% over the next 5 years and 2.55% over the next 30 years, respectively (see yellow and gray lines). In short, markets do not currently expect high inflation to persist—however, expectations can of course be wrong.

Figure 2. Expected future inflation as predicted by the breakeven inflation rate on US Treasury bonds (2010-2022)

Source: US Treasury Department

How Inflation Impacts Your Financial Plan

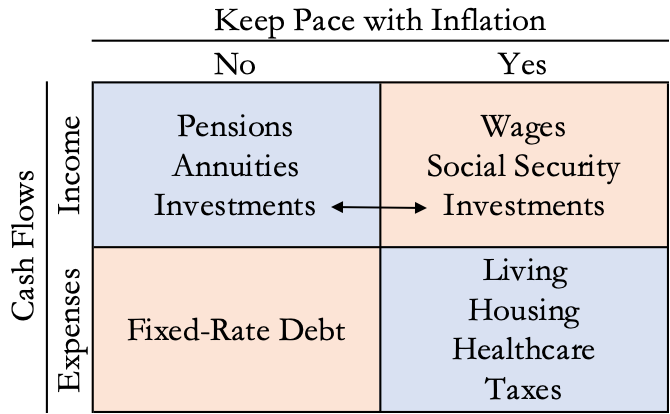

When it comes to your financial plan, reasonable assumptions must be made about the future. This includes forecasting future income and expenses, some of which may be expected to keep pace with or outpace inflation. For example, certain types of income, like wages and Social Security typically keep pace with inflation, while others like pension benefits and income annuity payments may not.[2] Some types of expenses, like day-to-day living costs, taxes, housing and healthcare costs typically keep pace with or outpace inflation, while others like fixed-rate debt payments may not.

How inflation impacts your financial plan will therefore depend on your unique mix of future income and expenses (Figure 3). Broadly speaking, a plan with relatively more income and fewer expenses that keep pace with or outpace inflation, respectively, will be better protected against rising prices. For example, a dollar of Social Security benefits is better than a dollar of pension income and a dollar of fixed-rate mortgage payments is better than a dollar of living expenses. (Note that investment income and earnings may or may not be expected to keep pace inflation, depending on the type of investment. This relationship is complicated and goes beyond the scope of this article.)

Figure 3. Certain cash flows in your financial plan may keep pace with inflation, others may not

How to Protect your Financial Plan from Inflation

Protecting your plan from inflation (particularly high sustained inflation) can be complicated, as there is no one-size-fits-all approach. For example, the challenges facing younger households with significant income, debt and savings goals will be quite different from older households looking to maintain their living standard throughout retirement. No matter your situation, there are several things you can do strategically to help protect your plan. And unlike what many financial advisors salespeople want you to believe, your best strategies rarely involve making significant changes to your investments.

In general, it’s important to focus on maximizing income and minimizing expenses that typically keep pace with or outpace inflation over the long-term (righthand column in Figure 3). This can help to insulate your plan from the negative compounding effects of inflation. Depending on your situation, this may involve

Increasing your lifetime wages by negotiating a salary increase, investing in education or training, transitioning to a higher paying job or delaying retirement

Maximizing lifetime Social Security benefits by delaying filing, ideally to age 70, especially for higher earning spouses, women, and those with dependents

Downsizing your home, especially by moving to one with lower operating expenses including maintenance, utilities, taxes and insurance

Reducing your overall living expenses, by saving more or moving to a lower cost area

Managing out-of-pocket healthcare costs in retirement by purchasing Medicare drug (Part D) and Medicare supplement insurance (Medigap) at age 65

Investing some of your savings in assets that may protect you from high sustained inflation, including TIPS, I-Bonds and stocks

Paying down or consolidating variable-rate debt, including credit cards and personal loans, into a fixed-rate loan

Keep Calm and Execute your Plan

Inflation can rapidly erode the purchasing power of money—e.g., hyperinflation in Zimbabwe in 2007 and Germany in 1923. Although inflation in the US is at its highest level in over 40 years, markets do not expect such high rates to persist. However, expectations can of course be wrong and inflation risk is ever-present, especially for those in or near retirement.

As with most things in financial planning, there is no need to make drastic changes. Instead, revisit your financial plan and think strategically about how you might better insulate those plans against (high sustained) inflation. In general, this means maximizing income and minimizing expenses that keep pace with or outpace inflation over the long-term. For younger households this could mean transitioning to a higher paying job, saving more or minimizing variable-rate debt. For older households this could mean working longer, delaying Social Security, downsizing or revisiting your investments.

Footnotes

[1] $100 / (1 + 8%) ^ 10 = $50.02. This concept is called the time value of money, which allows us to discount future values (FV) to present values (PV) or compound present values to future values. The standard equation used here is: PV = FV / (1 + Inflation) ^ Years.

[2] Many defined benefit pension plans pay a nominal benefit that does not adjust with inflation, while some index a certain percentage of benefits to CPI inflation with a maximum cap. Unfortunately, insurers do not currently offer income annuity products with inflation-adjusted payments, as is the case with Social Security.