Can You Afford to Maintain Your Living Standard?

Jay Abolofia, PhD, CFP® is a fee-only, fiduciary & independent financial planner in Waltham, MA serving clients in Greater Boston, New England & throughout the country. Lyon Financial Planning provides advice-only comprehensive financial planning for a flat fee to help clients in all financial situations.

Conventional financial planning relies on rules of thumb to generate its recommendations around saving and spending. That’s right! Most financial planners deliver recommendations based entirely on guesswork. At best, these recommendations can lead to a disruption in your financial future. At worst, they can be disastrous. In contrast, economics-based planning relies on facts and common sense to deliver accurate recommendations for your financial future.

Economics-based planning starts with the fact that you can’t spend more over your lifetime than you have in financial resources. Simply put, your lifetime spending must equal your lifetime assets. This concept is called your lifetime balance sheet. In what follows I describe the components of your lifetime balance sheet and show how it can be used to answer what may be the most important question in your financial life:

Can you afford to maintain your living standard throughout retirement?

Your Lifetime Balance Sheet

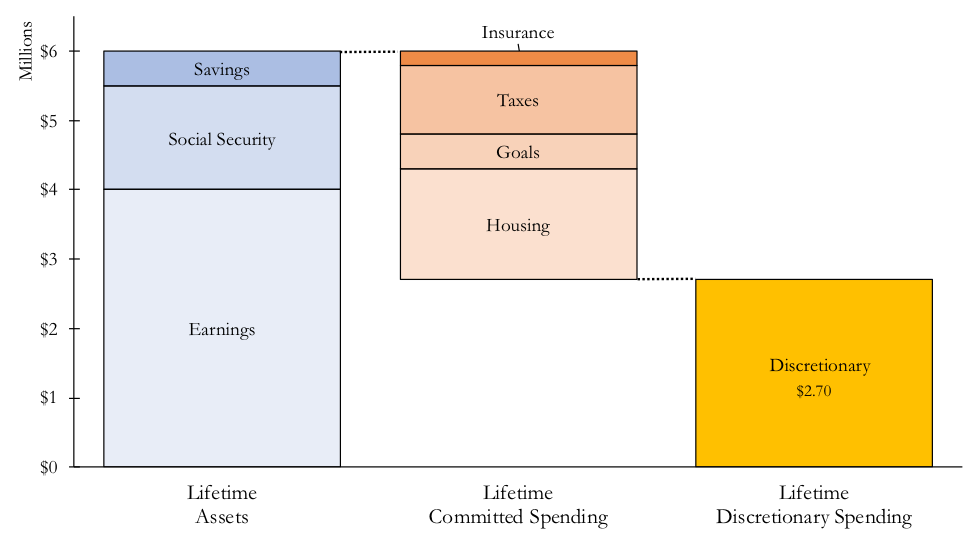

Unlike a typical balance sheet, your lifetime balance is prospective. On the asset side, it includes all your current savings and future lifetime income, like earnings, Social Security, pension and annuity income. On the liability side, it includes all your future lifetime spending, both committed and discretionary. Committed spending includes taxes, housing expenses, insurance premiums, and goals, like extra travel, gifting and college tuition. Discretionary spending is everything else that goes towards supporting your living standard. Things like food, clothing, travel, leisure and entertainment.

Consider the hypothetical lifetime balance sheet of Wanda Worker, a 40-year-old software engineer (see figure below). On the asset side, Wanda has $500K of savings between her retirement and non-retirement accounts, $4M of future earnings, and $1.5M of future Social Security benefits. Adding up her lifetime assets means that Wanda will have $6M to spend over the rest of her life. On the liability side, Wanda has committed future spending of $3.3M, including $1M of taxes, $1.6M of housing expenses, $200K of insurance premiums and $500K of goal-related expenses.

Given that Wanda can’t spend more over her lifetime than she has in resources, the difference between her lifetime assets ($6M) and lifetime committed spending ($3.3M) is the amount available for lifetime discretionary spending. In other words, over the rest of her life, she’ll have $2.7M to spend on her living standard.

Wanda’s lifetime balance sheet shows she’ll have $2.7M for discretionary spending to support her living standard

Your Highest Affordable Living Standard

Your lifetime balance sheet solves for how much discretionary spending you can afford over the rest of your life. The next logical question is how you will spend it on a year-to-year basis. Economics-based planning employs the common sense idea that people prefer to maintain a smooth standard of living throughout their lives. In essence, no one wants to splurge today and starve tomorrow, or vice versa.

Consider Wanda Worker, a single person with no dependents. To estimate her highest affordable living standard, we divide her lifetime discretionary spending ($2.7M) by the remaining years of her life.[1] If we plan for Wanda to live another 60 years, to age 100, her highest affordable living standard is $45K per year ($2.7M divided by 60 years). This is a powerful finding! It says that Wanda can afford to spend $45K per year on discretionary spending, to support her living standard, while covering all her committed spending (see figure below).

Wanda’s highest affordable living standard is $45K per year ($2.7M divided by 60 years)

Solving for your highest affordable living standard allows you to answer the important question of whether you can afford to maintain your current living standard throughout retirement. To do so, simply compare what you’re currently spending to what your lifetime balance sheet says you can afford to spend. For example, if Wanda currently spends $35K per year on discretionary spending, we can say that she is saving too much. For every year she spends $35K, she’ll have the ability to increase her future lifetime spending by a total of $10K (i.e., $45K minus $35K). If she instead spends $60K per year, she is saving too little. For every year she spends $60K, she’ll have to reduce her future lifetime spending by a total of $15K (i.e., $60K minus $45K).

Don’t Leave Your Financial Future to Guesswork

Any serious financial planning requires a comprehensive look at your financial future, including projections around your income and committed spending. This is why your lifetime balance sheet is the cornerstone of your financial future. It captures your plans around work, family, housing and other financial goals.

Unlike conventional planning, which relies on guesswork, economics-based planning and your lifetime balance sheet solves for how much discretionary spending is affordable. This then translates to accurate targets for spending and saving on a year-to-year basis, which allows you to answer what may be the most important question in your financial life—can you afford to maintain your living standard throughout retirement?

Footnotes

[1] For couples and households with minor children this calculation involves more effort—it must account for economies of shared living and the relative cost of children to adults.

Learn More About My Unique Approach to Financial Planning