How Social Security Works and What to Know About Its Future

Jay Abolofia, PhD, CFP® is a fee-only, fiduciary & independent financial planner in Waltham, MA serving clients in Greater Boston, New England & throughout the country. Lyon Financial Planning provides advice-only comprehensive financial planning for a flat fee to help clients in all financial situations.

It’s no secret that Social Security is in financial trouble. Right on your Social Security statement it says that “by 2035, the payroll taxes collected [by the program] will be enough to pay only about 80 percent of scheduled benefits.” In other words, if Congress does nothing, one-fifth to one-quarter of all Americans will experience a permanent reduction in their benefits. In what follows, I describe how Social Security works, review the program’s financial standing and outline what you can expect in the future.

What is Social Security

Social Security works by pooling contributions from those who are currently working and paying benefits to those who are currently eligible. It’s a wealth transfer between generations.[1]

The Social Security Administration (SSA) levies a 12.4% payroll tax on wages up to an annually adjusted wage base.[2] Workers and their employers each pay half, while the self-employed pay the entire amount. Payroll taxes account for over 90% of total program receipts, with the rest coming from income taxes on benefits and interest on trust fund savings.

Program receipts go to the Old-Age, Survivor, and Disability Insurance (OASDI) trust fund that immediately pays benefits to those who are eligible. The trust fund is essentially a savings account managed by the US Treasury. When program receipts exceed immediate benefit payments, excess funds are invested in US Treasury bonds and held in reserve for future periods. When program receipts are insufficient to cover immediate benefit payments, bonds in the trust fund (if available) are redeemed to cover the shortfall.

Nearly all program expenditures go to paying benefits, with less than 1% spent on administration. Eligible beneficiaries include retirees and their families, surviving spouses and dependents, and those who are disabled and their families. The program calculates your Average Indexed Monthly Earnings (AIME), i.e., your inflation-adjusted average monthly earnings over your highest paying 35 working years.[3] Using your AIME it then calculates your Primary Insurance Amount (PIA), from which monthly Social Security benefits are ultimately calculated.[4]

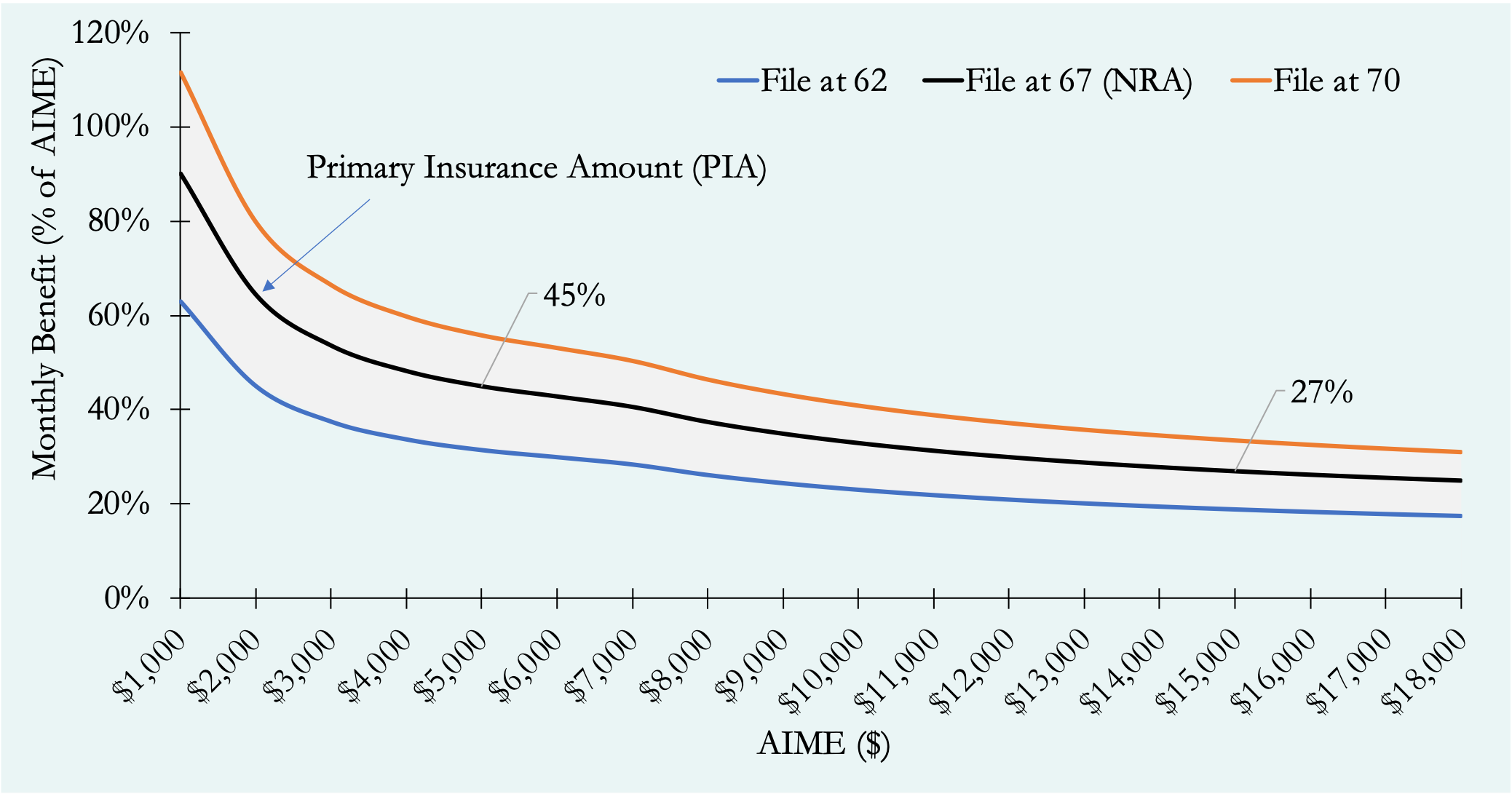

The PIA formula is progressive, meaning Social Security provides proportionally higher monthly benefits to lower-income workers. For example, retirement benefits may replace about 45% of a middle income worker’s AIME vs about 27% for a high income worker (Figure 1). Your retirement benefit may also be lower or higher than your PIA depending on your age when you file. For example, compared to filing at your normal retirement age (NRA) (black line), filing at the latest age possible of 70 increases your benefit by 24% (orange line) while filing at the earliest age possible of 62 reduces it by 30% (blue line).

Figure 1. Social Security retirement benefits replace a higher share of earnings for lower-income workers. Benefits are also lower if you file before age 70.

Source: See footnotes [3] and [4].

Will Social Security Run Out

For forty years, Social Security has been cash flow positive. In 2021 program expenditures exceeded program receipts for the first time since 1982. By 2020, the trust fund held about $2.91 trillion, enough to fully cover 2.6 years of program expenditures (Figure 2).

At first glance, Social Security appears to be okay financially. However, given the magnitude of scheduled benefits (over $1 trillion a year) and the nation’s aging population, the program must rapidly draw down reserves to meet its obligations.[5] The Board of Trustees of the OASDI trust fund (“Trustees”) predict the trust fund will be depleted by 2035, at which point program receipts will be enough to pay about 80% of promised benefits (Figure 2). In short, the trust fund will run out but benefits will not.

Figure 2. Trust fund assets will be exhausted by 2035.

How to Fix Social Security

To understand what it will take to fix Social Security, the Trustees analyze the program’s cash flows over the next 75 years and beyond. To start, the Trustees sum up the present value of future program receipts, add them to the current balance of the trust fund and subtract the present value of future expenditures. What’s left is an estimate of the program’s financial shortfall over that period. For example, the Trustees estimate the program needs $20.4 trillion of additional assets today to pay all promised benefits over the next 75 years (that’s 1.1% of GDP over that time) (Figure 3).

The Trustees estimate that to close the $20.4 trillion shortfall, and pay all promised benefits over the next 75 years, requires an immediate and permanent increase in payroll taxes of 3.24 percentage points, a reduction in benefits of 20.3%, or some combination of the two.[6] If Congress delays until the trust fund is depleted in 2035, the required changes will be larger—e.g., a 4.07 percentage point increase in payroll taxes, a 24.9% reduction in benefits, or some combination.

Figure 3. Social Security needs an additional $20.4 trillion to keep its promise to beneficiaries over the next 75 years.

Source: 2022 Annual Trustees Report, Table IV.B6 (p 75).

How to plan for an uncertain future

Social Security will be unable to fully meet its financial obligations by 2035. Does this mean you should be planning on a future without Social Security? I don’t think so. Although the program clearly requires reform, as it did in the 1980s, it is far from being insolvent.

If the history of Congressional action vis-à-vis Social Security has taught us anything, it is that Congress tends to act in the eleventh hour to shore-up the program’s 75-year shortfall using a roughly equal combination of tax increases and benefit cuts. (Exactly what reforms will occur and when is anyone’s guess—here’s a list of proposals.)

For planning purposes, I recommend updating your financial plan accordingly. For example, in 2023, this means a 2.035 percentage point increase in payroll taxes (half paid by the employer and half by the employee) and a 12.45% decrease in benefits for all beneficiaries beginning in 2035. All things equal, this means your financial plan will require more saving and support less spending, especially if you’re younger. That said, no matter the changes, Social Security will likely remain the best longevity insurance most Americans could ever hope for.[7]

Footnotes

[1] In contrast, contributions to a defined benefit pension plan are legally owned by the contributor and are left to accumulate in the plan until the individual retires. Such pre-funded pension plans protect employees in case the company enters bankruptcy or goes out of business. There are no such protections in the Social Security program.

[2] Wages from certain federal, state or local governments are not covered by Social Security (i.e., you and your employer do not pay Social Security taxes), and typically have their own pension system. Importantly, any pension you receive from such work may reduce the amount of your Social Security benefits.

[3] The formula for your AIME is as follows: 1) take how much you earned in every year, up to the maximum contribution or benefit base for that specific year; 2) for years prior to the year in which you turned 60, inflate those amounts using the national average wage index; 3) rank your pre-60 indexed earnings along with your 60+ unindexed earnings from highest to lowest; 4) add up the highest 35 yearly figures; 5) divide the total by 420 months to get your AIME. Note that to qualify for retirement benefits, you must have 10+ years of earnings on which you paid Social Security payroll taxes. And, if you paid into Social Security for <35 years, all non-contributing years are considered zeroes in the AIME formula.

[4] The formula for your PIA is the sum of three separate percentages of portions of your AIME. The percentages of the PIA formula are fixed by law at 90%, 32% and 15%, respectively. Since the percentages are declining for each portion of your AIME, the PIA formula is progressive. The dollar amounts in the formula (called “bend points”), which govern the portions of the AIME, change annually with changes in the national average wage index. For 2023, if your AIME is greater than $6,721, your PIA = 90% x ($1,115) + 32% x ($6,721 - $1,115) + 15% x (AIME - $6,721). For example, if your AIME is $8,000 your PIA in 2023 would be $2,989.

[5] For every 65-year-old in 1985, there were 5 individuals aged 20 to 64. In 2020, there were 3.5. The Trustees predict that by 2035 there will be 2.7 and just 2.3 by 2080. This falling dependency ratio implies that fewer and fewer taxpayers will be supporting each eligible beneficiary, or alternatively, each taxpayer will be supporting more and more beneficiaries.

[6] Financially speaking, focusing on the next 75 years is entirely arbitrary. To accurately understand the program’s financial sustainability requires extending the analysis to the infinite horizon. In this case, the program’s financial shortfall triples to $61.8 trillion dollars (that’s 1.4% of GDP indefinitely). To make the program financially sustainable forever would require an immediate and permanent increase in payroll taxes of 4.5 percentage points, a reduction in benefits of 26.4%, or some combination of the two. Again, the longer Congress delays, the larger the magnitude of required changes.

[7] For example, as of the date of this article, you can NOT buy an inflation-adjusted lifetime income annuity from a private insurer. And even if you could, the private annuity wouldn’t come with all the ancillary benefits of Social Security, including disability, survivor, spousal, divorced, child and family benefits, etc.